Legacy Fund

Transforming your kindness into good works for generations to come through planned giving.

The Golok Blue Valley Foundation intends to continue its work well into the future. You can be an important part of this future by including us in your estate plan or through various legacy gift methods. Planned giving allows both donor and charitable organization to benefit. As the giver, there is satisfaction in knowing that your legacy will benefit the lives of others. A double benefit comes from knowing that a properly designed gift plan may also improve the donor’s financial and tax situation, often right away.

What Your Legacy Gift Supports

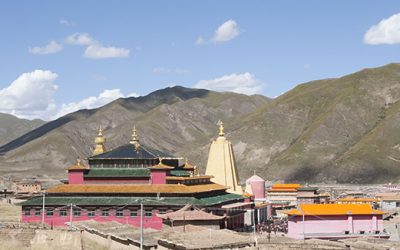

The BVF is committed to making real and measurable differences in the lives of the Tibetan Community living on the Plateau, who are in jeopardy of losing their traditional ways. In just 4 years, the Mayul Technical Vocational School, the first of its kind in Qinghai Province, has gone from a handful of young students to over 300, who are learning the critical skills needed to thrive in the 21st Century. We act as a lifeline to preserve culture while providing an opportunity for economic self sufficiency.

When a natural tragedy such as the Yushu Earthquake occurs, BVF helps support first responders providing for the immediate needs that only a Tibetan based foundation, like our sister non-profit, the “Mayul Foundation”, can pull together. Your legacy will help keep alive the ancient Buddhist Traditions by providing the large community of nomads, monks, and nuns medical care, proper housing, and support for the frail elderly. For decades, Hungkar Dorje Rinpoche’s work has been a primary source of care – giving medicines freely to tens of thousands. Your generous gift will help provide education and care for thousands more to come.

Are You Ready To Open Your Heart?

Please explore all the planned giving options below and on the linked pages. When you are ready to proceed in considering a Legacy Gift – or if you would like further information or have any questions about the process – please contact our Estate Planning Attorney:

Please explore all the planned giving options below and on the linked pages. When you are ready to proceed in considering a Legacy Gift – or if you would like further information or have any questions about the process – please contact our Estate Planning Attorney:

Justin Dituri | Phone: (303) 775-7525 | Email: Justin Dituri <justin@diturilaw.com>

For general information e-mail: Howard Stahl, President, Blue Valley Foundation: bluevalleyinfo@sbcglobal.net

Mail: Click here or on the BROCHURE IMAGE to download and print the brochure and return the tear-off form to the address provided.

The Blue Valley Foundation is a 501 (C) 3 non-profit charity under the Internal Revenue Code. All contributions are fully tax deductible.

Naming Golok Blue Valley Foundation in Your Will or Living Trust

You can name Golok Blue Valley Foundation as a beneficiary in either your will or through your living trust. This gift can be either a specific bequest, a remainder bequest, or a contingent bequest. It is important to know that you retain full use of any deeded property for life given to a charitable organization. There is the potential to receive income, capital gains and gift tax savings now for that future gift. Such a “planned gift” allows the donor to benefit, as well as the charitable organization.

PLEASE REVIEW THE GIVING OPTIONS HERE AND CLICK ON THE FOLLOWING LINK TO DOWNLOAD EXTENSIVE EXPLANATIONS AND EXAMPLES FOR EACH OPTION (PDF FORMAT). > Planned Giving Options and Examples (PDF)

Specific Gifts in Either Your Will or Living Trust

With a specific bequest you would leave a specific amount of property to Golok Blue Valley Foundation. Golok Blue Valley Foundation would be honoured to receive any property which you would like to bequeath to us. If there is some question about Golok Blue Valley Foundation’s ability to handle or maintain certain property please contact us.

Remainder Bequests in Your Will or Living Trust

A remainder bequest is usually a percentage of the amount of your estate which is left after the costs of estate administration, taxes, and satisfaction of any specific bequests. In this case you would be giving Golok Blue Valley Foundation a percentage of your estate, along with other family members, loved ones, or other charitable groups.

Naming Golok Blue Valley Foundation as a Beneficiary of a Retirement Plan or Life Insurance Policy

When you name a person or charitable organization (such as Golok Blue Valley Foundation) as a beneficiary of either a life insurance policy, annuity contract, or retirement plan, the named beneficiary receives that completely independent of what you may have said in any will or living trust.

Naming Golok Blue Valley Foundation as a Beneficiary of a Life Insurance Plan

Life insurance can be a very efficient way to make a gift to a charity, such as Golok Blue Valley Foundation, at your death. Life insurance death benefits are generally not subject to income tax and are paid in cash. In some situations, naming a charity as a beneficiary on a life insurance policy can assure that your family does not have to liquidate property to satisfy your desire to make a gift to charity.

Contingent Gifts in Either Your Will or Your Living Trust

A contingent bequest is a gift you make in either your will or your living trust which will only be filled if no one you have named to receive either a specific or remainder bequests is living at your death.

Charitable Remainder Trusts

The tax code includes a way that you may make a gift now and receive a charitable income tax deduction but retain the right to an income stream for a period of time, or your life, or the life of you and your spouse. However, it is required that, when the income distributions end, whatever is left must go to an exempt organization charity. This is called a Charitable Remainder Trust.

Naming Golok Blue Valley Foundation as a Beneficiary of a Retirement Plan

Golok Blue Valley Foundation has been approved as an exempt organization charity by the Internal Revenue Service under Section 501(c) (3). Leaving certain retirement plan amounts directly to an exempt organization can be a good planning strategy for some people. Certain retirement plan (such as IRA’s, 401(k), and 403(b)) distributions are taxable income to the beneficiary who receives them. An exempt organization charity is not subject to income taxation, so any retirement plan benefits which the exempt organization receives as beneficiary on the plan participant’s death pass without income tax. By skilfully structuring beneficiary designations, you can actually minimize income taxes resulting at your death, and increase the amounts which will go both to your family members and a charity.